Get the free property transfer affidavit detroit

Show details

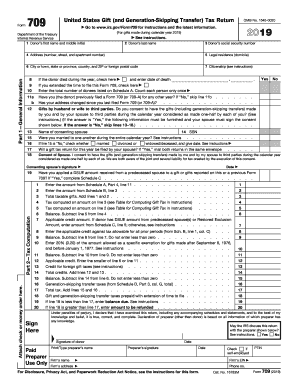

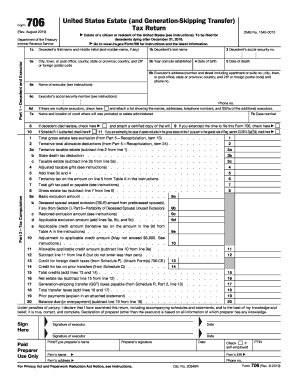

Items 10 15 ... Michigan Department of Treasury. 2766 (Rev. 05-16). L-4260. Property Transfer Affidavit. This form is ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer affidavit form 4260 it 45 days of the transfer

Edit your where do i file a have to pay a fine form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your detroit property transfer affidavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property transfer affidavit online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit city of detroit property transfer affidavit form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out where do i file a property transfer affidavit in detroit have to pay a fine form

How to fill out property transfer affidavit:

01

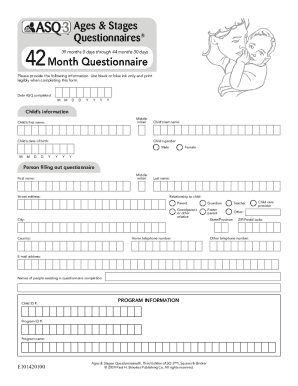

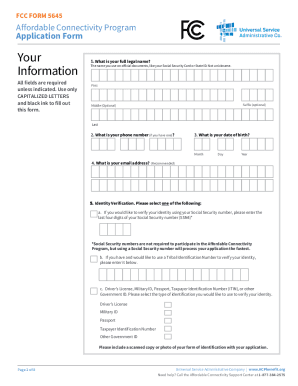

Gather all necessary information such as property details, transferor and transferee details, and any supporting documents.

02

Obtain a property transfer affidavit form, which can usually be obtained from the local government office or downloaded from their website.

03

Carefully read the instructions provided on the form to understand the requirements and guidelines for filling out the affidavit.

04

Start by entering the date of the transfer and the county where the property is located.

05

Provide the name and contact information of the transferor (current owner) and the transferee (new owner).

06

Include the legal description or address of the property being transferred.

07

Indicate whether the transfer is for consideration (money or other valuables exchanged) or without consideration (gift or inheritance).

08

If the transfer is for consideration, enter the purchase price or the fair market value of the property.

09

Provide details about any mortgages or liens on the property, if applicable.

10

Sign the affidavit in the presence of a notary public or other authorized individual and have it notarized.

11

Submit the completed form to the appropriate local government office along with any required fees or supporting documents.

Who needs property transfer affidavit:

01

Individuals or entities who are transferring property ownership, whether it is through sale, gift, inheritance, or other means.

02

Local government offices that require this document as part of the transfer process to ensure the proper recording of property ownership changes and to assess any applicable taxes or fees.

Fill

pdffiller

: Try Risk Free

People Also Ask about michigan property transfer affidavit form number

Where do I file a property transfer affidavit in Detroit?

your city's assessor's office. In Detroit, this office is in the Coleman A Young Building, 8th floor. You must file an affidavit within forty five days of signing the deed or you will have to pay a fine.

What is the property transfer tax in Michigan?

Calculating the Michigan Real Estate Transfer Tax State Transfer Tax Rate – $3.75 for every $500 of value transferred. County Transfer Tax Rate – $0.55 for every $500 of value transferred.

What is a property transfer affidavit in Royal Oak Michigan?

Transfer Affidavit (Form 4260) It is used by the assessor to ensure the property is assessed properly and receives the correct taxable value. It must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

Who files the property transfer affidavit in Michigan?

Title companies generally complete and file the Property Transfer Affidavit at the time of closing however; it is the responsibility of the buyer, grantee, or a transferee of the property to ensure that the form has been filed.

What is a transfer of affidavit in Michigan?

Transfer by Affidavit Twenty-eight days or more following the decedent's death, a person holding the decedent's property must deliver it to the decedent's successor when the successor presents the death certificate and a sworn statement. MCL § 700.3983.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute how to fill out property transfer affidavit 11 online?

Completing and signing what is a property transfer affidavit online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in form 2766 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your property transfer form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out property affidavit using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign michigan form 2766 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is property transfer affidavit detroit?

A property transfer affidavit in Detroit is a legal document that records the transfer of ownership of real property. It is used to ensure that changes in property ownership are accurately reflected in public records.

Who is required to file property transfer affidavit detroit?

The seller or the grantor of the property is typically required to file the property transfer affidavit in Detroit when the ownership of the property changes.

How to fill out property transfer affidavit detroit?

To fill out the property transfer affidavit in Detroit, you need to provide details such as the legal description of the property, names and addresses of the grantor and grantee, as well as any relevant sales information. It is important to follow the form's instructions carefully.

What is the purpose of property transfer affidavit detroit?

The purpose of the property transfer affidavit in Detroit is to officially document the transfer of property ownership for tax assessment purposes and to update public records, ensuring transparency in property transactions.

What information must be reported on property transfer affidavit detroit?

The information that must be reported includes the names and addresses of both the seller and buyer, the property's legal description, the sale price, and any applicable exemptions or dedications.

Fill out your property transfer affidavit detroit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Affidavit Form is not the form you're looking for?Search for another form here.

Keywords relevant to michigan property transfer affidavit

Related to michigan property transfer affidavit form number l 4260

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.